Bitcoin mining energy consumption. Exodus from China. Sustainable cryptocurrency.

The 1st half of 2021 was an important year for Bitcoin and the cryptocurrency market. The volatile bull and bear market, and also the raising question on the negative environmental impact of Bitcoin mining.

It came into the spotlight after Elon Musk tweeted about the massive energy consumption from Bitcoin mining and decided to divest some of his investment, not long after Tesla bought a $1.5 billion dollar in Bitcoin.

A lot of people (including his cultlike followers) are asking like what? is it true? how bad is it? so here are some answers to the question.

⚡Bitcoin mining energy consumption

Bitcoin mining is an energy-intensive industry. Not due to the labor intensive drilling activities as in a gold mine, but due to the high-powered computers required to solve complex computational math problems, or also known as "Proof of Work".

The more miners there are in the world, the harder it is to mine Bitcoin. Hence, the increasing value of Bitcoin also attracted more players to join in.

It's a pure zero-sum game, but unlike the klondike gold rush, it's geographically agnostic. So miners will flock to a location where energy is available in abundance and at a low cost.

Globally, bitcoin consumes around 110 terawatt hours per year, or one-fifth of Germany's entire annual energy consumption. In simple language, it's like your brain requiring huge amounts of sugary energy drinks to complete a statistic assignment in University.

The more you need to stay up late and think harder, the more you need to drink.

🛫Exodus from China

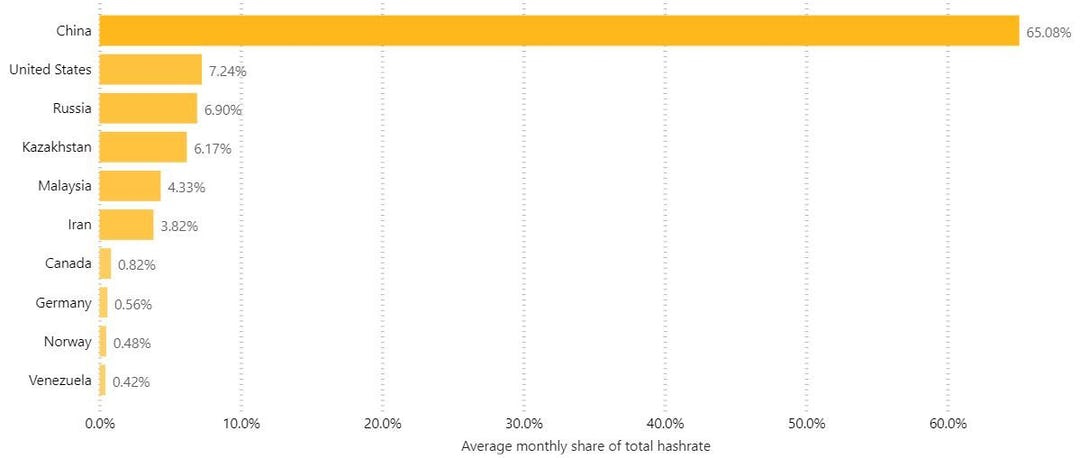

China has the world's biggest shares of Bitcoin mining (around 65% according to Cambridge university). Thanks to cheap coal energy, bitcoin mining is a booming business in the country.

However, China has now set a goal to be carbon neutral by 2060, which means that it has to significantly reduce its emissions and cut its reliance on dirty coal, and shift towards a more sustainable source of energy.

While it's good news for the planet, it has recently announced that to reduce the country's emission, Bitcoin mining will be banned from the Inner Mongolia region, one of the most active mining regions in China.

With this ban, the global hash rate will go down temporarily and make it easier for other miners around the world. Miners will have to find other places to set up shop.

One scenario would be to a region where energy is also cheap and abundant such as the US (e.g Texas) or Iran (Iran has also housed many mining operations which resulted in power outages in some of its provinces).

Other scenarios would be to regions where cryptocurrency regulations are more relax or nonexistent such as Iceland, Nigeria, Malaysia, or other emerging markets. However, there is also another potential solution, which is moving to renewable energy or making the system less energy-intensive, which we will discuss further.

Bitcoin mining shares globally (source: Cambridge University)

🌲Sustainable cryptocurrency

It is important to understand that the mainstream media has been unfairly comparing the energy used by Bitcoin to the fiat currency system. Fiat currency, or the money issued by our governments for us to buy our beer and pizzas, has a long stack of processes that also requires huge amounts of energy.

From the printing process in the central bank, various banks and intermediaries who manage and distribute the money, to the 24 hours ATM in every corner of a city. Not only in terms of energy consumption but there is also a geopolitical incentive for some currency to back the fossil fuel industry (Read more about petrodollar vs. bitcoin here).

While the concept of sustainability has been widely adopted in most industries, can it be implemented in bitcoin and other cryptocurrencies? there are actually several potential solutions:

The first solution is renewable energy.

Mr. Jack Dorsey of Twitter has recently published a white paper that argues Bitcoin could drive renewable energy. Most of the existing renewable energy sources are producing an excess since the supply fluctuates in nature (solar during the day, wind at night) and are usually located in an area where energy is not in high demand as in densely populated cities.

Even though innovation in battery technologies is moving in the right direction, it is yet to be economically scalable. Bitcoin mining is a perfect answer to this issue (Imagine a solar-powered wealth-making machine in the middle of the Sahara desert).

As the cost of renewable energy is going down, Bitcoin miners could piggyback on the excess energy while also providing a new revenue stream for the energy provider. If the founder of Twitter makes the effort to type more than the maximum words limit in a tweet, there might be some truth to it.

The Nordic countries, for example, could be a benchmark for sustainable Bitcoin mining, where it currently processes 1% of global Bitcoin transactions mostly through hydropower plants.

The second solution is changing how mining works.

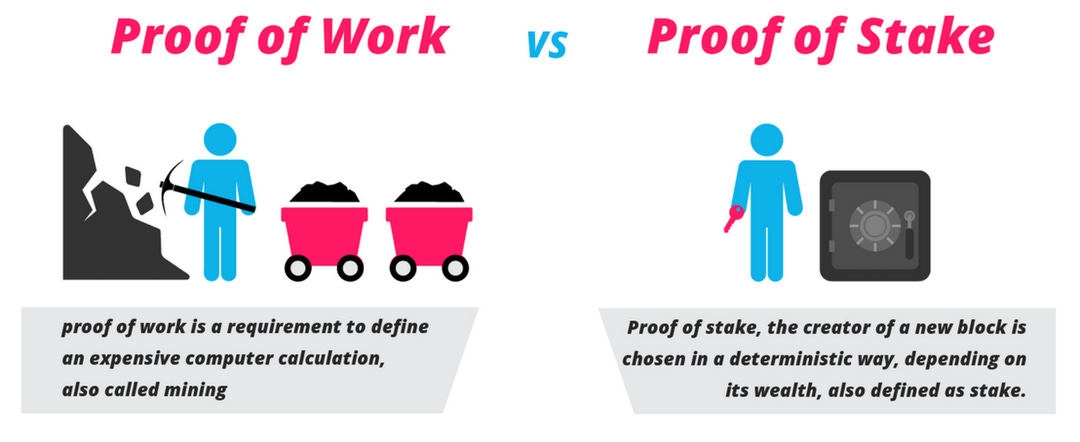

As stated earlier in this article, Bitcoin relies on the "proof of work" concept, where endless streams of computers need to compete to earn Bitcoin (similar to endlessly digging a gold mine). However, there is another concept called the "proof of stake", where a person can mine or validate block transactions based on the coins that they have deposited as a stake.

This means that instead of a race to the bottom by putting in more computer powers to earn a coin, the parties who put the most stake in the network will be selected to do the job. Imagine in a poker game, it is not the bank who draws the card, but the person who put the highest bets at the start showing skin in the game.

Ethereum, the world's second-largest cryptocurrency, is currently working to change its model to proof of stake to significantly reduce its energy consumption. Another example is Cardano, a new coin founded by Ethereum co-founder, which is already running on proof of stake and has a mission to be the alternative financial instrument for the unbanked population of the developing world.

The third solution is transparency.

Unlike the traditional financial markets, Bitcoin and other cryptocurrencies are still not fully regulated which means that there is no proper reporting published to the public. As more institutional investors and the average joes of the world are putting their money into Bitcoin, the pressure for ESG (environment, social, and governance) transparency is mounting.

For example, after previously denouncing Bitcoin, Elon joined forces with Microstrategy CEO Michael Saylor in the creation of the so-called bitcoin mining council, an effort to make Bitcoin more transparent and push the renewable energy agenda further.

Another example is Digiconomist, a platform that advocates the environmental impact of cryptocurrency and promotes more sustainable investing behavior such as carbon offsetting a bitcoin transaction.

In conclusion, No, Bitcoin is currently not sustainable (yet!). But it can and will be sustainable as more consumers, investors, and the wider public are becoming more aware of the use case of a decentralized currency and also its impact on climate change and the environment.

This is just the beginning of a green new monetary system, not just for the libertarian nerds, but for the greater goods of the planet and its inhabitant.

Thanks for reading this article. Enjoy life and keep asking questions!