🌿 Why do we need on-chain carbon credits and how to buy them?

Senken: the gateway to the web3 carbon ecosystem

The fastest way to scale investment in carbon projects is through the blockchain. At the end of 2021, after endless scrolling on crypto Twitter and listening to Bankless podcast, I learned about one of the most breakthrough innovations in sustainability. It is on-chain carbon.

In a simple explanation:

On-chain carbon is verified carbon credits that are recorded in an open and decentralized digital ledger. For every tonne of carbon recorded, a carbon token is issued as a digital currency that can be traded and used as an offset.

A pioneer of this technology is Toucan Protocol. Taking the approach of decentralized finance with liquidity pools and tokenomics for regenerative action.

I am a huge proponent of on-chain carbon and have written 2 articles about it “How to use tokens to preserve the environment” and “3 Carbon credits tokens that you can buy, HODL, or offset”.

However, there are still two challenges to the mass adoption of on-chain carbon outside the crypto geeks. First, is the lack of awareness of on-chain credits. Second, a bad user experience to purchase on-chain credits in the web3 ecosystem.

In this article, I will share my own experience with these problems. And also share my learnings from talking with René Schäfer, the founder of Senken, a web3 native carbon credits platform.

🙋 Education: Why do we need on-chain carbon credits?

Crypto and blockchain technology is not a scam. It's a game-changer technology if used for the right cause, such as on-chain carbons. The traditional carbon credit markets are still operating how the financial market used to operate before the internet and bitcoin. A manual and highly inefficient value chain.

Carbon credits verification is done by several standards that act as a trusted body. Trades are done through multiple meetings, phone calls, and emails. After purchase, buyers will receive a pdf document stating the carbon credits have been purchased and retired for offset. It’s all done based on trust and a legacy system.

Another point to highlight is price transparency. Buyers are connected with project developers through a middleman, the so-called carbon brokers. According to a Financial Times article, carbon credit brokers are buying low and selling high, up to 10x of the original price per tonne of carbon. It is estimated that they also take around 20% of the cut of the trade.

In 2021, the carbon market is estimated to be around $1 billion. And According to Mckinsey, it is expected to be a $50 billion industry in 2030, equivalent to the size of the global music industry in 2020. I’m not a financial expert, but it seems that tons of money is to be made as profit, instead of tons of carbon removed.

It’s time to have a more efficient and transparent carbon market with on-chain carbon. Replace manual demand/ supply and price mechanisms with algorithms. Replace trusted bodies with an open and immutable ledger, aligned with Satoshi Nakamoto’s principle of “don’t trust, verify”. And finally, replace Pdf documents with a digital proof of ownership.

💸 User experience: How to buy on-chain carbon credits?

To “walk my talk”, I wanted to buy some carbon tokens and tried to purchase them from Toucan and Klima DAO (one of the earliest projects build on top of on-chain carbon). It’s not an easy task. Definitely much harder than buying toilet papers from Amazon.

To buy my first carbon tokens, I need to explore the rabbit hole of the web3 world. Create a crypto wallet (e.g. Metamask). Send ETH (Ethereum) from my Coinbase account to a crypto wallet. Swap it in a decentralized exchange (e.g. Sushiswap) into Polygon Matic (another blockchain token). Pay gas fee (network fee). And finally, go to the Dapp (decentralized app) to buy the carbon tokens and ensure they arrive in the crypto wallet. If I told my Mom, she will probably only remember the sushi part of the process.

It’s not surprising that there are so many how-to videos on youtube teaching people how to buy carbon tokens. This long and complex process is not scalable. Climate change is a global coordination problem. We need to create a user-friendly experience to buy carbon tokens with several clicks. Thankfully Senken is here to solve the problem.

Example of various youtube videos teaching how to buy Klima carbon token

🟢 Senken: the gateway to the web3 carbon ecosystem

From the Regenerative Finance (Refi) Community, I got connected with Rene Schafer, one of the co-founders of Senken. Rene is a technologist with a philosophy and science educational background and decades of experience in digital consulting and startups.

I recently had a fun chat with him and learned more about his project, and why he is so bullish about on-chain carbon. Here are some blurps from our chat:

Nura: You have an interesting background. How do you decide to start a company on on-chain carbon?

Rene: After having 2 kids, I want to have more impact from my work. I met Adrian, my co-founder, and decided to work on highly impactful topics such as carbon emission and future-oriented technology like cryptocurrency. We previously tried creating an MVP product to quantify the emission of a user's crypto wallet. After diving deep into the voluntary carbon world, we learned that there are tons of issues that need to be fixed in the carbon market. For example traceability and transparency. After learning about the regenerative finance ecosystem that introduces on-chain carbon, we decided to found Senken.

Nura: Cool story. So what is Senken? How would you explain it to your 5 year old kid?

Rene: The main problem of climate change is carbon emissions. There are many projects that try to stop climate change by avoiding, capturing, or removing carbon emissions. For example, nature-based projects such as farming and mangrove conservation.

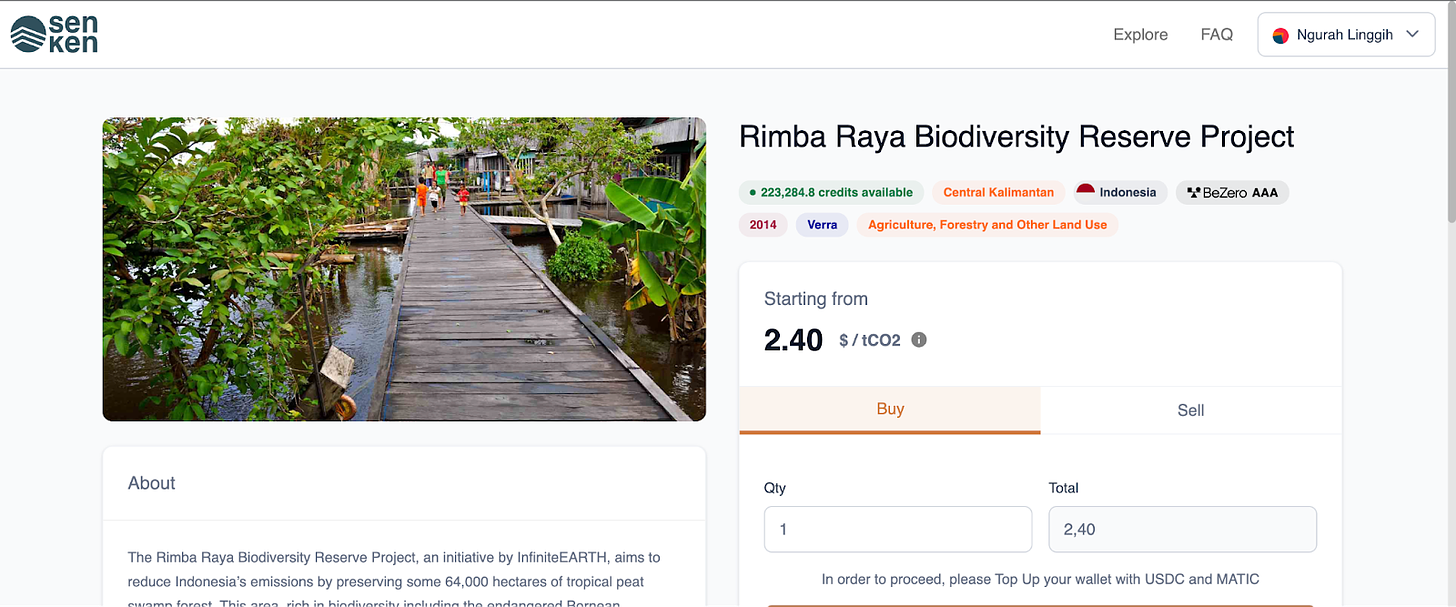

Companies want to invest in these projects to offset the emissions that they have created. Senken connects project developers with companies by providing a platform to trade carbon credits, specifically on-chain carbon.

Nura: But why on-chain carbon? what are the differences with traditional carbon?

Rene: In principle, on-chain carbon is not different from traditional carbon credits. The only thing that differentiates it is where these data are stored. In the traditional carbon market, several organizations controlled the data storage and distribution of carbon credits. Now it can be stored in an open database in the blockchain network. A new source of truth.

Nura: Web3 native people would agree. But why corporate buyers should care about it?

Rene: Off-chain carbon is non-digitized (remember it requires phone calls and sending PDF documents) and on-chain carbon is fully digitized. Digitalization creates visibility. With a serial number, buyers can easily track the characteristics, prices, locations, and other information that carbon credits would have. Being on the blockchain means that this data is transparently available, immutable, and auditable.

Nura: Awesome. So what problems are you trying to solve with Senken?

Rene: Similar to Coinbase for cryptocurrency, or Opensea for NFT, Senken helps users to buy on-chain carbon credits. We want to make it easy for people outside the web3 space to find and purchase on-chain carbon credits.

With Senken, you don’t need to have a crypto wallet or a cryptocurrency. You can easily create a profile with an email address and use a credit card to make a purchase. Our system in the backend will create a unique wallet address and convert your fiat money into stablecoins such as USDC or DAI.

Nura: I read that Senken was just launched a couple of weeks ago, congratulations to you and the team. So what is the current status of the project? and what does the future looks like for Senken?

Rene: We now have 20 carbon projects live and expect to have 40 million tons worth of carbon credits in the next months. Unlike the traditional carbon brokers in the web2 space which acquire exclusive access rights from carbon credit registries. Senken taps into the on-chain carbon pool and can scale up our volume easily (typical carbon brokers have 2 million tons of carbon credits). We will also partner with projects such as Flow Carbon and others to create an even bigger impact.

In the future, we would like to adopt other technology such as satellite sensor data to create digital imagery of the projects and add more visibility for the buyer. This data can be directly stored on-chain and not in an excel spreadsheet. It will be easier for the buyer to verify, monitor, and report the carbon credits that they purchased

Nura: Thanks for sharing Rene. I can’t wait to try it myself!

Buying verified on-chain carbon is now quick and easy

Conclusion

A lot of people in sustainability are still skeptical or ignoring on-chain carbons. But we are facing a climate emergency. Any innovation that gets us closer to the Paris Climate goals is worth trying.

"Black cat or white cat, if it can catch mice, it's a good cat” - Deng Xiaoping.

Cryptocurrency might have disrupted traditional finance. But on-chain carbon does not disrupt but rather regenerates the carbon market.

If you or your company are interested to learn more about on-chain carbon, check out Senken.io and see it for yourself.

(Disclaimer: this is not a sponsored message, I am genuinely enthusiastic about bringing regenerative finance to the masses).