🚀 3 innovations with on-chain carbon credits from Thallo

Two-way bridge, Dynamic pooling, and Carbon NFT royalty

Blockchain technology is not only helping to address issues with the current voluntary carbon market, but it is also leading to new innovations.

I learned a lot about 3 new innovations with on-chain carbon credits from Hayley Moller, Chief Marketing Officer of Thallo, a blockchain-based carbon credits platform.

In this article, we will learn about what breakthrough Thallo is working on: two-way carbon bridges, dynamic pooling, and carbon NFT royalty.

A cyberpunk illustration of a carbon bridge and a pool. Source: Dall E

🌳 What does a Web3 native carbon credits look like

Chris Dixon from a16z said that Web3 should not be skeuomorphic. This means that it’s not copying the looks and experience of an existing product in the physical world or Web2.

In Web3, we have the chance to create something totally new. Whether it is about ownership, monetization, or distribution.

This principle is also applicable to carbon credits. Bringing them on the blockchain is only the first step. There is much more that can be done. In my previous article “🌿 Why do we need on-chain carbon credits and how to buy them?”, I touched on several issues of the voluntary carbon market. From manual processes, lack of price transparency, and inefficient value chain.

While some of these issues can be solved with on-chain carbon credits, it creates other new problems such as the circulation of retired carbon credits. Triggering registries like Verra to stop its credits from going to the blockchain earlier this year.

However, the concept of on-chain carbon credits is still new and there is room for improvement. We should continue to try new things and not be afraid to fail in order to make progress, just like the Wright brothers did when they were learning to fly.

Source: tes

I was recently introduced by Ikarus from Wi venture to Hayley Moller, Chief Marketing Officer at Thallo. Hayley showed me that there are many potential uses for on-chain carbon credits, which made me hopeful about the future of this technology.

Here are some of my learnings👇

🟠 Thallo: A blockchain carbon platform

Let’s start with a short intro. I first heard about Thallo from the ReFi (Regenerative Finance) DAO Roundup newsletter #37. Thallo is building an efficient and transparent carbon offset marketplace. Making it easier for buyers and sellers of high-quality carbon credits to find each other.

Thallo was founded by a team of experienced climate and blockchain experts. Hayley, for example, has almost a decade of experience in strategic sustainability communications, working on climate action worldwide.

For buyers of carbon credits, Thallo provides a simple way to buy and access high-quality credits with transparent pricing. For project developers, Thallo opens up a new source of liquidity and market mechanism.

Thallo is also providing input to the big registries such as Verra and Gold Standard, working with smaller registries such as BioCarbon Registry and Ecoregistry (Cercarbono), and connecting directly with other players in the carbon market, including project developers and even independent third-party auditors also known as validation verification bodies (VVBs).

Thallo understands that scaling up the voluntary carbon market requires collaboration from all players. Creating a positive sum game for the whole ecosystem.

In our conversation, we discussed the 3 problems with on-chain carbon credits and how Thallo aims to solve them.

1. Two-way carbon bridge: moving credits on and off the chain

There was a huge buzz when Toucan Protocol and Klima DAO were launched two years ago. The 1st-time decentralized finance (DeFi) technology was used for carbon credits.

In its earlier version, Klima DAO used BCT (Base carbon tonne) from Toucan protocol, which is a token minted from retired carbon credits bridged into the blockchain to create its own KLIMA token. KLIMA token was backed by a pool of BCT, and minted as a representative of the actual carbon credits.

Though this is exciting, there is a weakness with this process. The tokenized credits cannot be brought back off-chain to the registry, also known as one way bridge. It means that the buyer is stuck with credits that cannot be used for offsetting and also can’t take advantage of price differences between off-chain and on-chain credits for arbitrage.

In a simple analogy, it would be frustrating if the photos you uploaded to Instagram were automatically deleted from your phone or iCloud and you couldn't download them again. Same with bridging carbon credits.

To solve this problem, Thallo created the world’s first two-way carbon bridge. Credits can be moved on and off the chain, allowing full flexibility for the buyer. Not only that, the buyer can also decide to retire the tokenized credits on-chain and receive a Proof-of-Retirement NFT.

All activities both off-chain and on-chain can be seen in an event log and are easily traceable in an audit. This creates integrity for the credit and credibility of individuals or companies that are doing carbon offsetting with Thallo. To do this, Thallo has partnered with an award-winning registry BioCarbon Registry, that is open to Web 3.0 innovation.

Illustration of the two-way carbon bridge flow, using Web2 API and Web3 smart contract. Source: Thallo

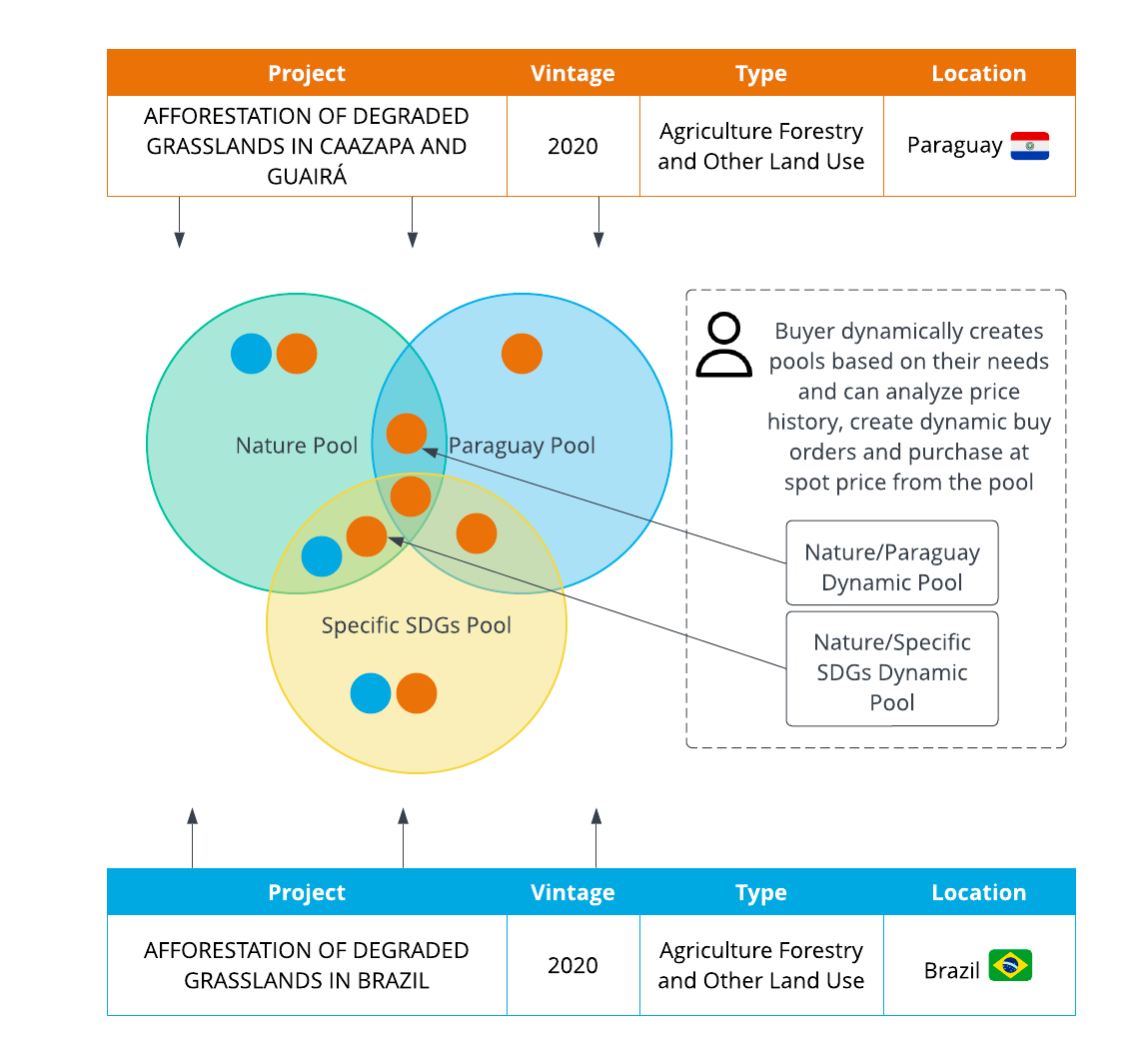

2. Dynamic pooling: selecting the right projects for company’s sustainability goals

Most tokenized carbon projects are using a process called pooling where various carbon credits are bridged on-chain and put into one pool. Price is determined based on average and supply and demand. This innovation is a good start to bringing credits on-chain, creating easy access to huge amounts of credit liquidity at once.

However, I learned from Hayley that carbon credits are not a commodity like silver or gold. It is more like real estate. Where each credit is priced based on the project criteria, such as locations, vintage (year an emission reduction occurred or the offset was issued), methodologies, etc.

With the current static pooling system, project developers are given the wrong incentives to supply low-quality and low-price carbon credits. Projects that were previously not attractive in the off-chain voluntary carbon market (for example because of questionable methodology or low integrity) are now hidden inside these pools. Thallo called it a liquidity problem.

“It tends to have a race to the bottom effect and diminish the economic incentives to bring in more expensive credits” said Slaptain Shwirv in This week in ReFi podcast episode 26.

Thallo came up with a brilliant solution called dynamic pooling. Where buyers can select credits that are most suitable for them and create their own pool. For example, a company might choose a mix of projects that are aligned with their sustainable development goals, price ranges, and type (nature-based or selected technology).

I like to imagine it as a filter in an eCommerce website. Where we can select our own filter and only shown products that matched our criteria. Every user on the site will have different product assortments depending on their filter.

With dynamic pooling, Thallo provides flexibility for the buyers while also creating a new incentive for project developers to supply high-quality credits with optimal pricing. As the old saying goes, don’t buy a cat in a bag.

Illustration of dynamic pooling, credits from 3 different pools. Source: Thallo

3. Carbon NFT royalty: a new source of funding for project developers

In a traditional sales process, for example in the sale of a painting, the artist only receives a profit during the first sale. The artist does not receive additional profit when the items are sold again in the secondary market.

NFT (non-fungible token) royalty totally changed this concept. The creator can set a fee that is programmed in the NFT to receive a share of the sale every time the NFT is sold and resold to different buyers. The royalty is immutable and can provide long-lasting economic benefits for the creators.

But what this has to do with carbon credits?. In Thallo’s recent report “Fast Forward: Challenges to Scaling the Voluntary Carbon Market”, they found that project financing is one of the biggest challenges, especially for small to mid-size project developers.

Thallo is developed with the project developers in mind. That’s why it will use an NFT royalty model in its carbon credits token. Project developers can receive a share of the sales every time the token is sold to a new owner if it's not yet burned (retired) for offsetting.

When arbitrage happens (buying low, selling high), project developers will also benefit from it. This is a new source of funding that was not in any project developers' wildest imagination before blockchain. These funds can then be reinvested to develop more carbon projects. A win win win strategy for the whole voluntary carbon market ecosystem.

💡 Conclusion

It takes time for new innovations to be widely accepted and for them to be fully developed. For example, it took about 10 years after the Wright brothers' first successful flight for the first airline to be established.

Tokenized carbon credits were only introduced in 2021. But we are already seeing some interesting developments, like what Thallo is doing. Thanks to Hayley for sharing these insights. I am looking forward to seeing how this area will continue to grow and evolve in the coming year.

If you or your company are interested to learn more about on-chain carbon, check out Thallo.io and see it for yourself.

(Disclaimer: this is not a sponsored message, I am genuinely enthusiastic about bringing regenerative finance to the masses).